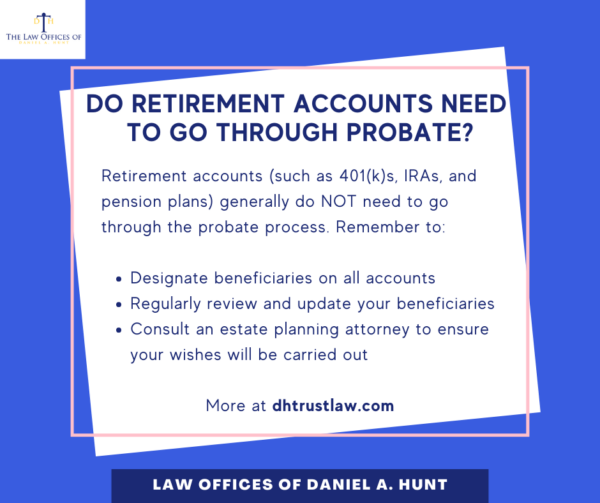

Do Retirement Accounts Need to Go Through Probate?

Navigating the complexities of estate planning can be daunting, particularly when considering how different assets are handled after one’s passing. One common question is: Do retirement accounts need to go through probate? Understanding the probate process and how retirement accounts are treated within it is crucial for effective estate planning and ensuring that your assets are transferred according to your wishes.

What is Probate?

Probate is a legal process that occurs after someone dies. It involves validating the deceased person’s will, if one exists, and administering their estate, which includes distributing assets to beneficiaries and paying off any debts. In California, probate proceedings are public, lengthy, and costly. They often involve court supervision, legal fees, and expose the estate to public scrutiny.

How Probate Affects Different Assets

Not all assets are subject to probate. The assets that typically go through probate are those owned solely by the deceased and not designated to pass directly to a beneficiary. These might include individually owned bank accounts, real estate held in the deceased’s name alone, and personal property.

Retirement Accounts and Probate

Retirement accounts, such as 401(k)s, IRAs, and pension plans, generally do not go through probate if they have designated beneficiaries. When you set up a retirement account, you are usually asked to name one or more beneficiaries who will inherit the account upon your death. These beneficiary designations take precedence over instructions in a will and allow the assets to bypass probate entirely.

Why Retirement Accounts Typically Avoid Probate

Retirement accounts typically avoid probate for two reasons:

- Beneficiary Designations: When you designate a beneficiary for your retirement account, the account automatically transfers to the named individual(s) upon your death. This direct transfer mechanism bypasses the need for probate.

- Account Agreements: The agreements you sign when opening a retirement account typically include terms that ensure the account is transferred directly to the beneficiary without involving the probate court.

Exceptions to the Rule

While retirement assets generally avoid probate, there are a few potential exceptions:

- No Beneficiary Designation: If you fail to name a beneficiary or all the named beneficiaries predecease you, the retirement account may end up being included in your probate estate. In this case, the account would be subject to the probate process and distributed according to your will or state intestacy laws if no will exists.

- Estate as Beneficiary: If you name your estate as the beneficiary of your retirement account, the account will go through probate. This is generally not recommended due to potential tax implications and the added complexity of the probate process.

- Contested Beneficiary Designations: If a beneficiary designation was contested and deemed invalid by a court, this could cause the account to be included in the probate process.

Steps to Ensure Your Retirement Accounts Avoid Probate

To ensure your retirement accounts do not go through probate, consider taking the following steps:

- Designate Beneficiaries: Make sure to designate primary and contingent beneficiaries for all your retirement accounts. This ensures there is a clear path for the transfer of assets.

- Update Beneficiary Designations: Regularly review and update your beneficiary designations, especially after major life events such as marriage, divorce, the birth of a child, or the death of a beneficiary.

- Consult with an Estate Planning Attorney: An experienced estate planning attorney can provide guidance tailored to your specific situation and help ensure that your retirement accounts and other assets are transferred according to your wishes without unnecessary delays or complications.

Retirement accounts typically do not go through probate due to the beneficiary designations that direct their transfer upon the account holder’s death. You can avoid probate and facilitate a smooth transition of your retirement funds to your loved ones by ensuring your beneficiary designations are current and seeking professional advice.

If you have any questions about whether retirement accounts need to go through probate, feel free to contact our law firm.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.